Athleisure and active beauty are converging -- Marketers, will you take advantage of their parallel rise?

December 7, 2023The gym is no longer where people go to simply work out — now, fitness centers are where consumers socialize, and are a central component of their lifestyle. This has spurred a growing convergence of the wellness, beauty, and fashion sectors. The athleisure industry raked in $44B in 2016, and is projected to grow to an $83B business by 2020. But athleisure is only one part of the active look — consumers are now seeking out specialized beauty products to look their best before, during, and after their workouts.

A wide range of brands — including established brands like Aveda, challenger brands like Drunk Elephant and Sweat Cosmetics, even high-end brands like Chanel and Dior — are taking advantage of this shift by producing new clothing styles, cosmetics, and hair care products that meet the needs of these fashion-forward gym-goers.

Social video platforms, particularly YouTube, have proven to be key destinations as consumers seek out cosmetics tutorials and clothing reviews, and form their brand decisions along the way. The rapid parallel growth of athleisure and active beauty on social video represents a tremendous opportunity for marketers to meet consumer demand for more cross-over video content, and position their brand to be the first thing consumers see when they’re searching for athleisure and active beauty content on social video platforms.

Let’s take a deeper dive into these growing spaces on YouTube:

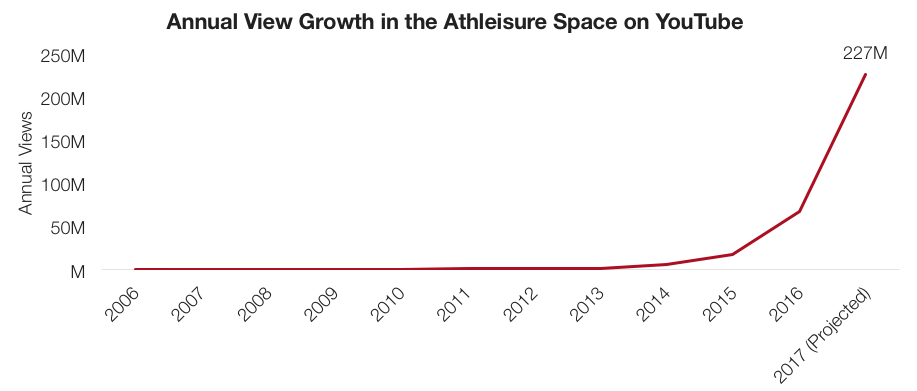

Athleisure

The athleisure space on YouTube mirrors the growth in the industry, growing by more than 4X year-over-year in 2016. More than 2K creators have produced a total of 7K athleisure videos, attracting more than 128M total views. In 2016, the athleisure space gained 67M views, and Pixability projects that the space will attract another 227M views in 2017.

One athleisure brand that’s chasing this growing audience on YouTube is Fabletics. Led by Kate Hudson, the brand engages its audience through high-quality, long-form video content with a frequent publication schedule, releasing videos almost weekly.

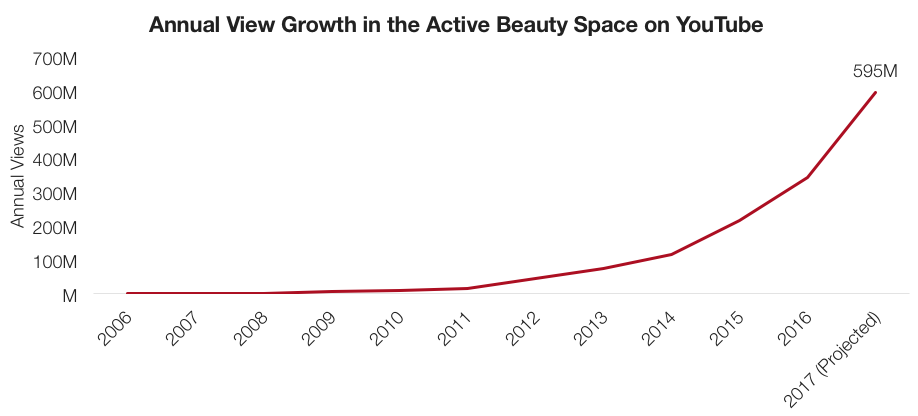

Active Beauty

In conjunction with athleisure, consumers are turning to YouTube to search for tips, tricks, and tutorials for makeup, hair, and skin regimens that suit their active lifestyles. Though active beauty is a more recent consumer trend than athleisure, it’s dominating on YouTube with close to 1.1B total views. The space grew by more than 2X in 2016 over the previous year, attracting more than 343M views, and Pixability anticipates that it will gain another 595M views in 2017.

Active cosmetics is the most popular subcategory within the active beauty space, drawing more than 878M total views (followed by active hair care, with 193M total views, and active skin care, with 46M).

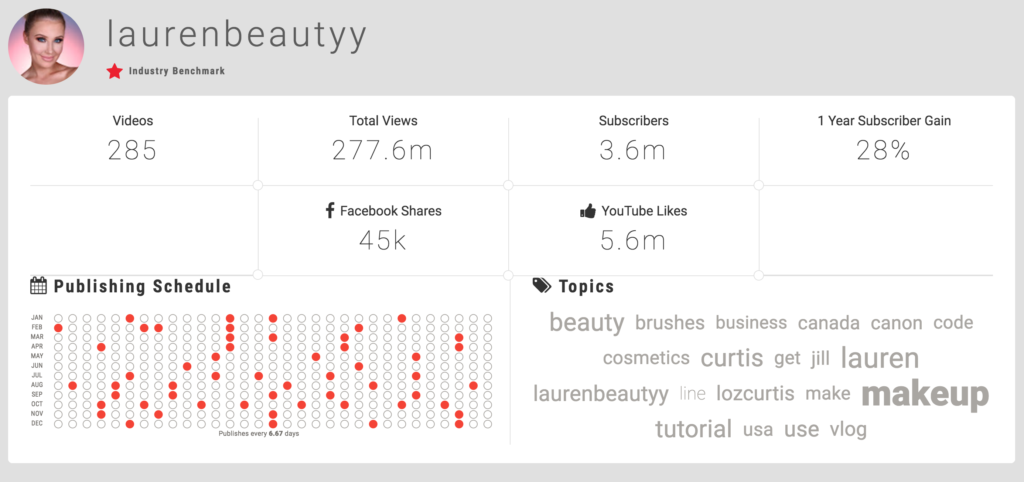

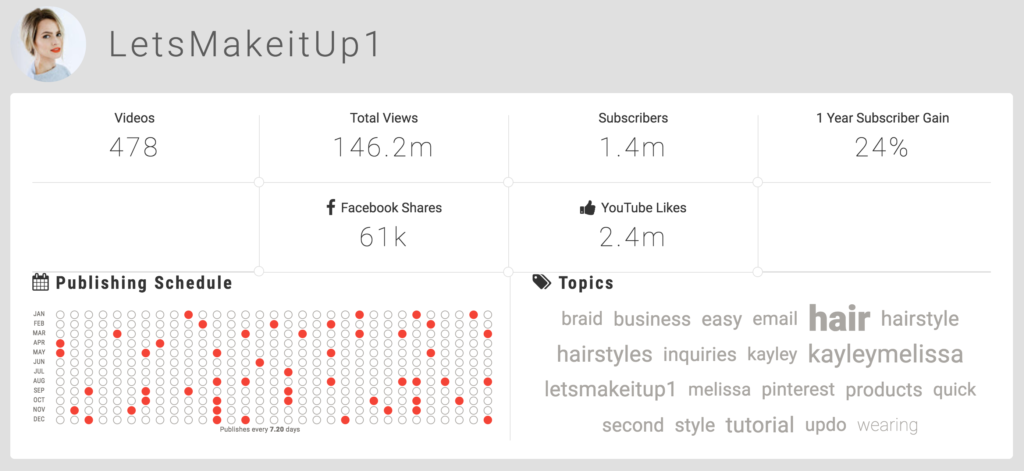

This is driven by consumers tuning in to learn how popular creators like Lauren Curtis (3.6M subscribers) and Kayley Melissa (1.4M subscribers) apply active cosmetics to look their best at the gym.

We’ve rounded up several brands that are seizing on consumer demand for active beauty content on YouTube:

-

Active Hair: Aveda is stealing the show for dry shampoo, topping the charts with 506K views of its dry shampoo-related content on YouTube. Sephora and Avon UK trail with close to 28K and 5K views respectively of their dry shampoo videos. There’s a significant opportunity for these brands to close the gap by producing relevant hair content that active consumers are clearly hungry for. Interestingly, the fourth-most popular dry shampoo brand on YouTube is Birchbox Man (attracting more than 4K views of its dry shampoo content), which shows that while the majority of the active beauty audience is female, beauty marketers should not ignore the male beauty audience.

-

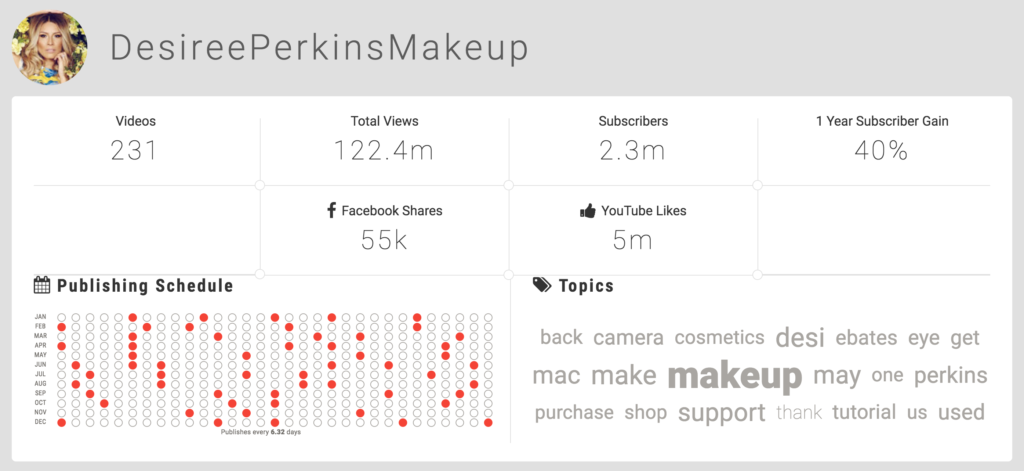

Active Hair: Indie hair care brand Ouai is making waves with a robust YouTube presence that takes advantage of the high demand for active beauty video content. The brand’s channel is optimized for a compelling viewing experience, featuring longform made-for-digital content that’s uploaded regularly, including popular tutorial videos that feature its dry shampoo foam, and partnerships with in-demand influencers like Desi Perkins.

Active Cosmetics: Tarte Cosmetics recently launched an active beauty line featuring skin care products, sweatproof mascara, and dry shampoo, marketed at on-the-go fitness enthusiasts. Tarte partnered with beauty influencers for a digital-first video campaign that attracted more than 100,000 views.

Several challenger brands have captured a piece of the active beauty market, and have an opportunity to further capitalize on the trend through cross-platform paid and organic media strategies:

-

Active Cosmetics: Drunk Elephant initially carved out a niche for itself in the active beauty space by selling directly to consumers. Now, Drunk Elephant partners with Sephora for distribution, where it has become a best-seller. With nearly 69K followers on Instagram, the indie brand currently lacks a YouTube channel. The brand could take advantage of the unmet need for active beauty content by investing in YouTube to extend its growing influence across platforms.

-

Active Skin Care: Sweat Cosmetics was founded by professional athletes who recognized the need for sweat-resistant and sunscreen-imbued makeup. The brand’s strategy has paid off with monthly revenue up by 560% in 2016. However, the brand has yet to invest in its YouTube presence — its channel has only a handful of subscribers and a few thousand views — which presents a great opportunity for Sweat Cosmetics to increase its reach among its core audience.

Wellness, beauty, and fashion continue to converge as the gym evolves into a more social space, and consumers are turning to social video platforms to understand how to complete their active looks. Beauty and fashion marketers are faced with a massive opportunity to capitalize on the rise of these complementary trends through organic and paid video strategies. Armed with data and insights on the overlapping beauty and fashion spaces, marketers can better recognize emerging creators to partner with, high-performing placements to target paid media against, and trends to capitalize on as they develop new content.

Contact us today to learn more about how Pixability’s technology can help your beauty or fashion brand make an impact on YouTube.