Webinar Recap: How to Optimize Audiences to Drive ROI on YouTube and CTV

Last week I had the pleasure of joining TV data expert Moe Chughtai of MIQ, and industry legend Rob Norman on an AdWeek webinar discussing the challenge of driving outcomes on YouTube and CTV. We unpacked some of the following issues:

- The impact of recent drastic changes in video consumption

- How to effectively build new audiences and re-create existing audiences on YouTube and CTV

- The best ways to ensure brand suitability on YouTube and CTV

If you weren’t able to tune in live for the webinar, you can check out the recording here, or see below for the webinar transcript.

Webinar Transcript

Rob Norman:

Let me run you through how this is going to work, we’re going to cover three big areas today. One is the big shift that everyone’s aware of, from linear viewing to streaming platforms accelerated by Covid as you all know. The opportunities that present for an audience-first future as big screen consumption starts taking on more and more of the characteristics of online advertising and marketing. And lastly, we’ll do some Q&A right at the end.

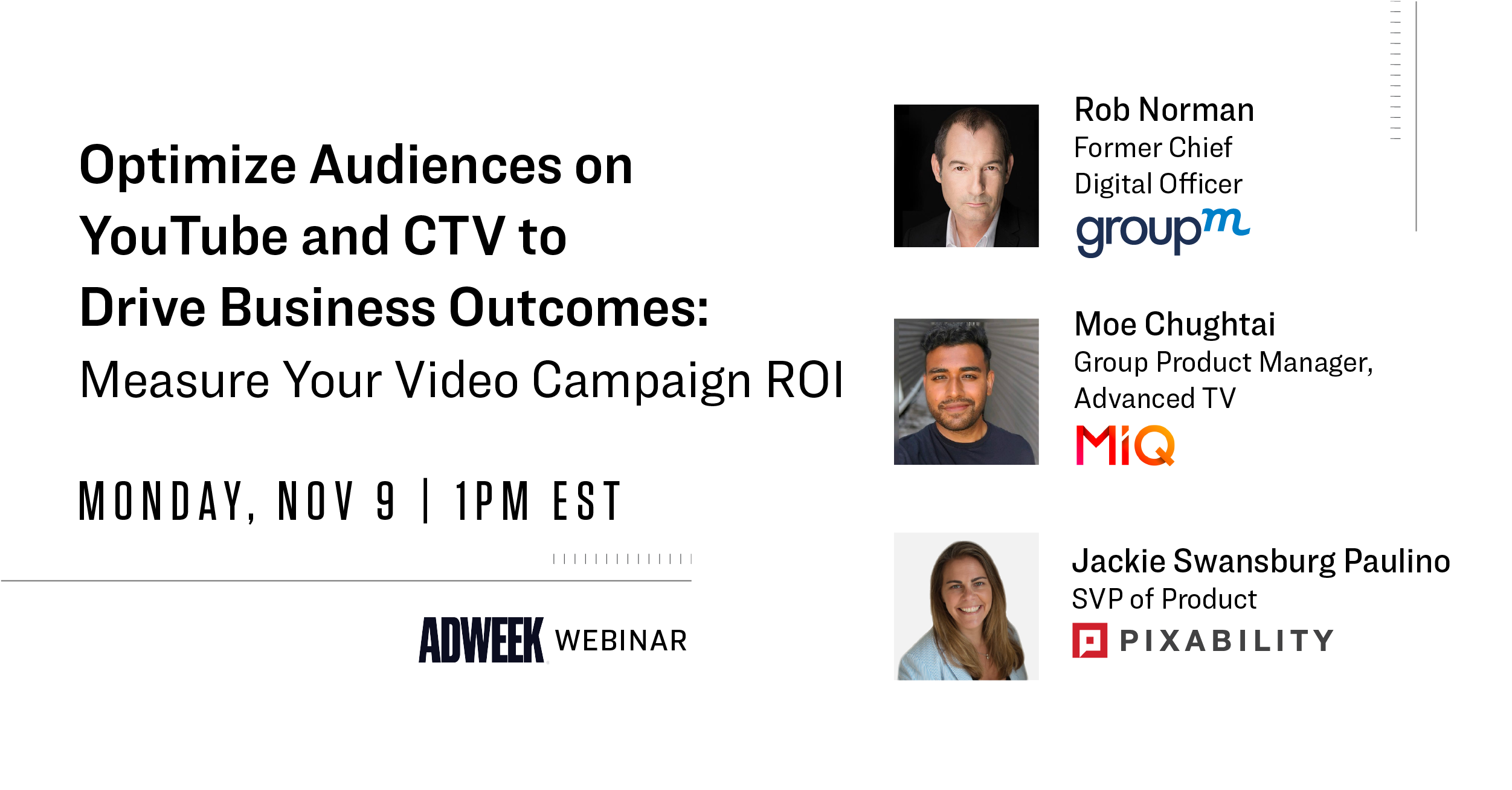

So, as Caroline said, my name is Rob Norman. I am the Former Chief Digital Officer of GroupM at WPP. And when she says former, she means it. I haven’t been that since the end of 2017. But among the other things I do, is I’m very proud to be an advisor to both MiQ and Pixability. And I’m delighted to be joined today by Moe Chughtai, who is the Group Product Manager for Advanced TV at MiQ. And by Jackie Paulino, the SVP of Product at Pixability. So, to be here with colleagues and friends is a pleasure.

Pixability is a leading player on YouTube and Connected TV. The business is headquartered in Boston and is one of the YouTube marketing partner program members, a designation that was newly created this year. MiQ is a programmatic specialist. They work across every form of programmatic media, an omnichannel in that sense, and with an increasing practice in advanced TV, that Moe leads. So we’re in good hands here today.

So let’s just talk about the market for a second, if we can. And note that there are going to be around 212 million users of connected TV within a couple of years from now, and this represents the most extraordinary growth. And if you look at the bottom axis, it’s back 2010 and forward to 2023. Now, in contract, the number of paid TV viewers, so these people are the ones that not only have a subscription to the cable itself but also to cable television, has been in secular decline during the last few years. And will have dropped from its peak by about 23%, 24% by the time we get to 2022, 2023. So we’ve reached a point of inflection, in which those two lines have crossed. And that means that anyone who is planning advertising has to think a lot about the relationship between linear TV, and especially about what they can get out of connected TV on behalf of their brands. Or, in the case of agencies and buyers, on behalf of their clients.

The dilemma that many of us face is, how to really understand what the streaming market looks like. So, we’ve got two big buckets here. One is the over the top media, all the names that everyone is familiar with: Netflix, Tubi, YouTube TV, Hulu, the newly launched Peacock, the not quite so newly launched Disney+, and many others of course; along with Amazon Prime. And then a whole different category of activity in the market of connected devices. Now, in some of those cases, the people that provide those connected devices are also providers of programming and providers of inventory. So there is indeed an ad-supported Roku TV, there is of course an ad-supported Fire TV, but not an ad-supported Apple TV on the Apple proprietary programming.

So we’ve got this big mix of different providers in the marketplace that we have to kind of understand to appreciate it. So ad impressions, as opposed to overall video impressions, are not being replaced at the same rate as the loss from linear TV. Whereas overall viewing impressions are up, many of these viewing experiences, and of course the most notable one is on Netflix, is not a platform that carries advertising.

So let’s just look at how that part of the world is organized. And so you see that 29% of households have Netflix, 22% have YouTube TV, 14% have Hulu TV. And of the top five streaming services, YouTube and Hulu are the only ones that are ad-supported. Now, we understand that when people look at some of the others they say, “Well, there are ads on ESPN,” for example. Well, that’s true, but there’s no ads on this version of ESPN. And there are ads on Fire TV but not ads on Prime Video.

So when we try and understand the taxonomy of the market overall we’re really looking towards YouTube and Hulu and some of that group on the right side, along with Pluto and Tubi and parts of Peacock as well; some of the subscribers of Peacock, to understand the ad inventory. And if you kind of drag this out, stretch the definitions a little bit and think about YouTube in the broader sense of not just YouTube TV the streaming service, but YouTube consumed on the big screen and of course YouTube consumed everywhere else, the total share of impressions of all of these providers very much tilts in the direction of YouTube.

So, what we’ll do is we’ll be talking about all of those. And I am going to hand this over now to Jackie and to Moe to pick up the main meat of this session. So, Jackie, over to you.

Jackie Paulino:

Thank you Rob, and thanks to Moe for being here as well. I can’t think of two other men in the industry I’d rather talk CTV and YouTube with, so thank you very much.

So just to reiterate some of the points that Rob just made, and call out why it even makes sense to talk YouTube and CTV in one webinar. So, at Pixability, we specialize in YouTube and other CTV platforms like Roku and Amazon as well. So, for YouTube, I think a lot of people in the past couple of years have thought about it as a mobile app or what you watch in the office during lunchtime, right? But YouTube is the number one ad-supported app in your living room. So it’s super exciting to get kind of the reach of linear, but with a targeting of digital.

And then, on YouTube specifically, it’s got the highest reach and most viewing hours among ad-supported OTT streaming services. TV screens are actually growing faster than any other device on YouTube. And at Pixability, for a given campaign, we see TV screens make up sometimes over 35% of impressions that are served on TV screens in the living room.

Moe Chughtai:

The thing I get really excited about with YouTube and connected TV specifically here is, how similar the audience experience is when you are watching programming on YouTube, as any other connected TV app. For a user, if you’re a viewer, if you’re watching Property Brothers rebroadcasted or reindicated on YouTube, I know I do that a lot. There really isn’t a difference between me watching that on YouTube on my big TV screen versus going on the HGTV app, or the Sling app, or one of these other applications and watching Property Brothers there. And so, from a user perspective, increasingly these platforms are sort of converging and seeming pretty similar.

Jackie Paulino:

So I think now that you got a little bit of the lay of the land from Rob and Moe and I, we’re going to focus our webinar on two things. One: One thing about CTV, you should take an audience-first approach. We’ll walk through a detailed example of why and some data and targeting you can utilize in this approach. And again, like I said on the last slide, this is really exciting because you get the kind of eyeballs and reach of living room TV, but the data from all these different things that we’re going to talk through.

And two, you should measure and optimize your campaigns differently than a traditional linear buy, and we’ll give you examples of this as well. And we’ll show you the results you can expect from CTV and YouTube campaigns if you follow our lead here.

Moe Chughtai:

Perfect. And just to talk about two broad ways to do that sort of audience-based buying on YouTube and connected TV. We found, really, there are two broad buckets of tactics that brands tend to use with digital video advertising, where it’s sort of finding your viewers where they’re contextually relevant. So this might be when a viewer’s watching a video based on the topic or the keyword in the video, like a sports car for a Mercedes audience, or CarGurus, or one of these publishers that are very contextually focused towards that audience.

And the other is trying to find that audience in other sort of consumer touchpoints, where maybe they’re not reading about or watching contextually relevant content but they’re still sort of in the purchase behavior. And so, what Jackie’s going to talk about in a little bit is just, as a consumer goes through the experience of researching and looking for a brand’s product, there’s a lot of touchpoints that they tend to view where there’s an opportunity to reach the audience, maybe using more audience-first or digital-first targeting tactics. So that could look like targeting someone based on their affinity to a dealership, if you’re a car manufacturer. Or we’re marketing someone or we’re targeting someone based on whether they’ve been to a brand’s website.

These tactics have been long engaged in the digital world. But what we’re really excited about is we’re starting to see those seep into YouTube and connected TV buying as well. And they give you the opportunity to make your advertising a bit more effective by starting with the audience as opposed to trying to figure out, from a contextual basis, where they’re likely to be.

Jackie Paulino:

Cool. Thanks Moe, yeah, I’ll jump in with two kinds of YouTube specific, or Amazon, more kind of the walled garden specific things on top of the remarketing example that you gave. But custom intent audiences, for example, on YouTube, you can actually target people who have searched for something on Google, it could be on their mobile or on desktop, and then target them when they’ve moved to a TV screen. Similarly, with Amazon, Rob mentioned Fire TV as an example, you can actually target people who have looked or put something in their cart on Amazon and then again target them with an ad on their TV screens which is really, really cool.

So, I’m going to walk through an example here, a personal example of what I’ve been focused on in quarantine the last three months, keeping myself busy. So, over the last three months, I’ve been researching which SUV I want to buy. I decided on a Jeep, which Jeep, and which dealer to buy it from. So you can see kind of my path to move from awareness, to consideration, to actual purchase … which I haven’t purchased yet, but decided where and what.

On the top, the dots here are specific digital touchpoints of my research; doing online research, price searches, reading reviews. And you can see as I kind of move through the funnel here. On the bottom are actual videos I’ve watched, mostly on YouTube. But I’ve actually watched reviews, different things specific to my journey of buying a Jeep. Each of those things that I’ve done here, would put me into different buckets of auto intender audiences, right? So the things that I mentioned on the last slide.

But that’s not all I’ve done in the last three months, right? I haven’t only been focused on this. So after I’ll watch a Jeep review video, for example, I’d go to New York Times Cooking YouTube channel and watch a few videos and then maybe I go to my Roku or turn on my Fire TV, I have both, and watch some content there as well.

So, back to kind of what Moe was talking about and the targeting that’s available across all the platforms on CTV that we’re talking about. There’s two different strategies to reach me on CTV and on YouTube; the Jeep buyer, right? So, on the right, you can see in a gray bubble is Jeep-specific content. And on the left are things that I have done after I’ve been put into an intender audience, in the yellow bucket.

So to fully leverage the data that’s available on the audience targeting, you really should be focused on this audience-based approach. So it means, yes, that you might serve an ad while I’m watching New York Times Cooking, but it’s right after I went to jeep.com. I did watch several Jeep videos as well, and obviously that’s a great time to reach me as well. And during that process, you could serve an ad there as well. But there’s also lots of auto content that I didn’t watch, right? I didn’t turn on my CTV and watch the NASCAR app or anything like that. So those could be potentially ways that impressions served to someone who’s just really into cars but is not necessarily into buying a car at that moment.

I should also note here, so within these bubbles are things that I just felt Jeep would find brand suitable. And things outside of these bubbles are things that may be not brand safe or brand suitable to Jeep. So you can see the little Barbie logo all the way to the left. Jeep can still run audience-based targeting without running on kid’s content that I’m watching with my niece. That might not be the best time to reach me during my journey. And I’ve put some news on the outside of the bubbles as well as … during the last week or so, of course, it’s been a lot of politics and things going on. So if brands wanted to stay away from that, again, you can still do an audience-based approach but from a brand safe angle as well.

Moe Chughtai:

Yeah. And just to speak to that, I don’t know if I’d put Barbie and the news in the same category in any other incidence but from a brand suitability perspective, over the last week, it feels like it sort of makes sense that you want to avoid those two.

Just to kind of build on what Jackie just mentioned here, she mentioned in her journey to research Jeep content she was actually watching content that’s sort of similar or related to the auto buying journey, right? So watching videos about different cars that are out there, going on YouTube, searching for content related to that purchase journey. But importantly, she was also spending a lot of time on platforms and publishers that aren’t directly related to auto, if you just look at them on the surface.

I think what we found is if you’re running a campaign and trying to manage frequency and performance across a wide diversity of publishers, it’s important to find viewers when they’re in the right mindset for auto content and advertising content related to cars. And so that’s where the content-first approach really matters. But Jackie sort of mentioned this, which is not everyone who’s watching Top Gear or watching auto-related content is going to be in market for a Jeep in the next few months, right? And so we really emphasize for brands the importance of looking at audience and using an audience-first approach, whereby you’re trying to find viewers who have showed interest in Jeep content and have already been added to a intender segment for example, but are spending their time across ESPN, Roku, the kind of open web there. Both within some of the garden of YouTube, but also kind of out on the open web.

And so if you’re putting together sort of a frequency strategy, typically what we find brands doing is overemphasizing some of their exposure opportunities to the audience that they know for certain are likely to be intenders. Taking an audience-first approach regardless of publisher. And then obviously spreading out the remaining impressions on contextual strategies as well. The mix of those two is really important but the audience-first tends to be kind of first and foremost, especially in this new digital video and TV world.

Jackie Paulino:

Definitely. Yeah. I’ll jump in there too. You definitely want to make sure that you get that overlap, right Moe? When you get content plus audience, that’s extremely powerful. So when you get an intender who’s in the moment on a car review channel, you definitely want to kind of leverage that and make sure you’re optimizing towards that as well.

Moe Chughtai:

And so, Rob kind of mentioned this early on, right? When we were looking at the diversity of platforms that are out there in this new streaming landscape. And by the way, those logos on the slide that Rob referenced were really US logos but we’re seeing similar trends, just different logos, in other markets as well. What we’re finding is the viewers on CTV have more options for content than ever before. It feels like every few months there’s a new CTV application or a new platform or publisher that launches. And if you look at the market size of any of those publishers, very few of them … and you saw that with the slide that Rob referenced … very few of them have a majority or even really a plurality of audiences that are available in TV.

And so, when you’re looking to plan for a TV audience, especially if you’re looking at an audience for strategy, we found looking at sort of a holistic video strategy that includes a diverse set of publishers, is almost as important as the publisher selection as well. So, obviously Jackie kind of mentioned this, it’s really important and valuable if you can find an intender audience when they’re consuming auto content. That sort of right person, right place, right time. But if you’re only running your campaign there, you’re going to run into scale issues really quickly, right? So it’s important to be able to find that audience on a diverse set of publishers.

And so, typically, some of the key considerations we talk to brands about is … and these start to get a little bit more tactical, but they’re important on the tactical side. If you’re running across multiple publishers over the course of a campaign how do you think about allocating budgets across those, right? Do your planning tools allow you to see a single audience, like a Jeep intender audience, across YouTube and Sling and Roku and some of these platforms? Are you able to fluidly allocate some of the budget across these? That, obviously if you’re a linear buyer coming into the digital realm, that budget allocation’s look a bit tougher. And you want to be able to leverage the flexibility of digital to allocate budget across different platforms.

And then, one of the big challenges that we hear kind of consistently from buyers is, “Well, how do I catch frequency across different platforms? Especially if some of them are closed and some of them are open.” And so, really, I think this is where technology selection becomes really important. But some of the things you want to look at are: Do the technology platforms that you’re looking at have the ability to view and sort of cap an audience across different platforms? And make sure you’re maximizing reach through that ecosystem.

Jackie Paulino:

Great. So I think we’ve made the point for why an audience-based approach. And I’ll let Moe talk a little bit about why measurement makes sense.

Moe Chughtai:

So, on the measurement side. I mean, this is one of the most exciting things for me in the sort of shift from linear to streaming, that raw kind of reference in the beginning, is, for a marketer, it doesn’t just mean you’re able to reach an audience addressably across multiple platforms, it adds … As Jackie mentioned, reaching that intender audience across all the platform that they’re on. But equally importantly, there is an opportunity to measure an individual impression to an actual outcome that a brand cares about.

Jackie, those aren’t outcomes that … typically in a video world, marketers look at the likes of a rating point, or average frequency across an audience, or completion rates. You’re really starting to look at tangible business outcomes, right?

Jackie Paulino:

Yeah. Totally. Like you said Moe, this is the most exciting part of taking what used to feel like the real old school linear and moving it. We’re still in a living room, there still can be multiple people watching, but we can measure all the way into … And, again, we’re starting on a TV screen but then we can measure cost per dealership visit down to a conversion on a website, or even in store and matching offline and online sales. So there’s lots of different things. All these are actually specific metrics that we’ve seen at Pixability, and things that we’ve optimized for different brands.

So, we do still have advertisers who think of YouTube and even YouTube on TV screens or CTV as an awareness kind of higher-level play. But we’ve seen a big shift over the last couple of years of people really moving to outcome-based advertising, and realizing we should be measuring it. Even if it’s not the number one KPI for a specific campaign. Even if you want to get eyeballs and reach is really important. It’s still important to … what’s the outcome, right? If we’re marketers or advertisers, we all kind of want to sell a product or get someone to sign up for our service and we should understand how these video campaigns are influencing those things as well.

So I think, not to totally say … none of these things are a golden bullet or anything like that, a silver bullet. But at Pixability what we do is we have all this data; we have vertical level data, we have all of our campaign data, we get a lot of data, especially across YouTube. We like to say we’re kind of starting the race ahead here. But even if you start the race ahead, no two campaigns end up being exactly the same. So what we do is we optimize continuously across campaign. And again, it’s important to what we’re measuring and understand what the KPI of the campaign is. But to understand that sometimes a content-based approach is actually going to work really well, sometimes an audience-based will always win.

We typically do see the audience-based targeting here is in blue, and the content-based is in yellow. So, the campaign that’s on the right for a fashion industry, kind of on par between the two. Where on the left, you can see the consumer electronics audience-based worked much better. So, as anything in digital advertising, it’s important to measure, optimize, and learn, and continue to do so. And, again, that’s what’s great about this, is that we’re not making quarterly or monthly optimizations, we can make real time optimizations.

So to wrap up, just to reiterate what to think. Here, audience-first, again, you can do this in a brand safe, brand suitable way within brand safe content, even if you kind of take a audience-first approach. Make sure to measure audience engagement is fine, are people watching your campaign, kind of in a lean back? Are they clicking on it? But then, again, measure business outcomes. Again, even if it’s not the number one KPI, we really think you should be thinking: This is outcomes-first, what do you want your consumers to do? And then optimizing towards that.

And that’s everything from us. I’ll pass it back to Caroline. I think we’ve got a bunch of questions coming in, which is great. And I think I’ll jump in on one thing that I just saw in the chat. All of the stats that we mentioned upfront, that Rob mentioned, those are US stats. So just to touch on that as well.

Caroline Cakebread:

Awesome. Well, thank you so much Jackie and Rob and Moe, that was great. A lot of really awesome information there.

So, like Jackie just said, we’ll move into the Q&A portion of our presentation today. So just a reminder, if you have a question for any of today’s speakers ask using the question tool on the left side of your screen. We’ll get through as many as we can over the next 10 to 15 minutes. But if we don’t get to your question, we’ll make sure it’s forwarded over to today’s speakers so they can reply to you offline.

Second quick reminder, that today’s webinar is being recorded and we’ll be emailing out a link to you later this afternoon.

All right. So, let’s get to it. Jackie, I will pose this first question to you: Are there ways that we can help clients who are primarily TV advertisers, make the shift to YouTube and other CTV platforms?

Jackie Paulino:

Yeah, definitely. I mean, first this is exciting. I think we’re still really behind on this shift happening. I just read a stat this past weekend. So, now, CTV makes up 25% of TV viewership but it still only accounts for 12% of ad spend. So, for agencies and marketers and brands alike, let’s continue to accelerate this shift.

And to do so, I think one thing we use a lot at Pixability, is we use the Googles Reach Planner tool. It’s nice, it shows you kind of where the overlap of your audience is and how you can get incremental reach from YouTube and households that you would not reach before. So that’s really resonated with marketers that we’ve talked to, to just really understand that you’re missing out on entire households if you’re only buying linear TV.

Moe Chughtai:

And just to kind of add to that. I think the industry level stats are really, I think, just blatantly obvious here that the investment needs to match the audience behavior. And we see that with a majority of brands that we work with that are sort of linear heavy. They’re trying to figure out how to move into streaming and really trying to figure out how to allocate that budget. And so, typically what we find with brands when they’re first starting out is, they’ll tap some of the larger platforms on that list that Rob mentioned early on, when they’re planning out their CTV campaigns. And especially if you’re a large linear buyer mover into CTV, it’s very easy to over frequency an audience on some of those larger platforms.

And I’m sure we’ve all been watching an episode or a show content on an app, and seeing three or four of the same brand’s ads over and over and over again and been frustrated. I think the importance there that we’ve seen when we’re working with new brands, is helping them identify that audience across a variety of publishers. Not just one or two. And making sure that they’re managing expectations across those.

Caroline Cakebread:

Awesome. Well, thanks so much. If no one else has anything to add I’ll move on to our second question here. Moe, I’m going to pose this one to you. The question is saying that one of the challenges they’re seeing is that many CTV platforms only let them measure view rates that are extremely high since the ads are often unskippable. Are there ways to get deeper measurement on CTV?

Moe Chughtai:

Yeah. It’s a really good question. So, I think this kind of goes back to our point of buying TV content in the streaming world allows you to do types of measurements that really just weren’t possible before. So, one of the earliest KPIs that we see brands adopt is completion rate, and that’s carrying over the best practices from their video budgets into their online video budgets and to connected TV. If you’re looking at completion rates on connected TV though, we see anywhere between 90% all the way up to 99%, depending on the platform. And it’s exactly what you were mentioning Caroline, or the question asker is mentioning, is most of CTV content is non-skippable.

I think the types of metrics that we try to move brands towards when it comes to CTV, is metrics like: Are viewers who saw an ad visiting your website after the fact? So, what’s the site visitation rate from a CTV ad? Or what’s the conversion rate on a website? Or if you’re an offline brand, like a retail brand or a dealer brand, many of these CTV technology platforms, including what MiQ offers, is the ability to sort of tie that impression using something like an IP address, back into an offline action or an online action. And so, we’re starting to see brands use those metrics more and more, and we encourage that.

Rob Norman:

Hi, might I jump in just on that one as kind of the old man of the group. Yes, put measurement into three big buckets. There are internal measures of media, which are things like reach, frequency and completion rates. There are measures of marketing, which is about awareness and preference. And there are measures of business, which are about qualified leads and sales.

So it’s really important, when we’re thinking about CTV or any other form of advertising, to try and think about what measures we’re trying to optimize for. And when we don’t have those pure measures, and what we have to do is we have to find models and inferences that say, “If we can move awareness from A to B, or preference from R to F, then we start moving sales from T to Q.” And this is part of the bigger science of attribution and media planning that CTV has added a layer of complexity to, but it’s brought a new layer of data to an accountability to the big screen that we didn’t have before.

Thank you.

Caroline Cakebread:

Awesome. Thanks for adding that in there Rob. Great question.

All right. Let’s move on to number three. Jackie, I’m going to shoot this one at you again: You mentioned you can be brand safe and suitable and do audience targeting. How does that work? Wouldn’t you be running around all content if you’re focused on an audience strategy?

Jackie Paulino:

Yeah. Great question. I’m glad that this popped up in the questions. And I think there was some other questions that popped up specific around children’s content too, I gave that example so I’ll talk to that a little bit too. So yeah, it’s definitely possible. I would say it’s really what we focus on at Pixability, brand suitability and safety is extremely important to all of our advertisers. And especially when you’re working on user generated content sites like YouTube, where there’s content uploaded 500 hours every minute, I think is the latest stat, so it’s really important. I would say that the way to do this is to measure as well as plan in a brand safe way.

So a lot of people kind of work with brand safety measurement partners which is important, and I would definitely suggest doing that to measure where you did run. But you should also work with someone in the planning process to understand where you’re going to run. We are one of those people, we help kind of curate inventory on YouTube and across CTV in a brand suitable way.

There isn’t an easy fix to this unfortunately, from a planning side. We’ve invested a lot of years, time and data science to solve this problem, and we’ve done webinars specific just to this topic. But what we do is, again, we put content into specific different buckets and then we’re always adding to that as kind of a negative channel strategy. So, we can do that. We’ve done inclusion list strategies as well, so we’re actually picking all of the channels and apps and shows that we run on specifically, or we can do kind of the opposite of that as an exclusion strategy.

So I would say, depending, it’s really important for you as a brand marketer to define what’s most important out of your campaign. Do you want to run on specific content? And I should also mention, you can do that with an audience strategy. So you can say, “I know that these 20,000 YouTube channels are safe and I want an auto intender audience,” that’s possible on YouTube and scalable. But you can also say, “I just know there’s types of channels I don’t want to run on.” And I gave the kids example, because that does come up quite a bit where a lot of advertisers consider that kind of a wasted impression, whether it is or not.

So, we’ve curated tens of thousands of YouTube channels that are specific to kids content and we run those as exclusion lists for all of our advertisers that ask for it.

Rob Norman:

I’d like to say one thing. Suitability is the key issue here. There is a huge spectrum of the idea of suitability of content for brands. And people talk a lot about the notion of user-generated content, but of course users generate the context as well. And so the advertisers default should be: It’s okay to advertise in the content that the consumers watching. And so you have to be very sensitive to come at the brand safety and brand suitability argument from the right end of the spectrum. And if you base it on an exclusion first model, you’re not only excluding opportunities for your brand to reach an audience but actually you’re also excluding monetization of some perfectly worthwhile media content producers as well.

Caroline Cakebread:

Moe, I’ll pose this question to you. This is something I’m actually interested in too, so I’ll be curious to hear what you have to say: Should TV advertisers change their creative if they want to use it on CTV or YouTube?

Moe Chughtai:

Yeah, Caroline. That’s such a good question. And it really speaks to, I think, the importance of considering the platform and the publisher that you’re running on with your CTV campaign and your YouTube campaigns and not just the format. When budgets started to move from linear to connected TV, I think one of the first things we saw was brands really repurposing some of the TV creatives that they had running on linear and just running the same 15 and 30 second ads on YouTube and connected TV as well. I think increasingly what we’re seeing is brands are seeing the return on investment for customizing their creatives specific to the streaming world.

If you think about what matters to a streaming audience, it really depends on what platform and what options of control that user has, right? So on YouTube, you have a skip button and you’ve got 5 seconds to really grab the consumer’s attention, or the viewer’s attention. And if you don’t do that within the first 5 seconds, that skip button is right there for the viewer at the end, right? So brands where, in linear, you’re really focused on a 30 second storyboard and telling a story over that 30 second view time, for YouTube specifically and for publishers that do have a skipability element, it becomes a little bit more important to think about: How do I capture attention early on?

The same thing is true, I would say, on connected TV as well. It just gives you a little bit more option to customize. So one of the things that we found is difficult for brands, if you’re running across multiple publishers and forums, is how do I get the investment dollars to create different versions or create for an audience? And so, MiQ, internally, has a sort of creative shop that is able to work with brands and customize a creative and do minor tweaks to optimize creative for a different format or a different publisher. But publishers allow end cards, for example. So if you’re an auto brand, a lot of our auto customers prefer us to insert a couple of seconds at the end of the video to direct a viewer to the closest dealership, for example.

The same thing is true if you’re a retailer who has some products that they’d like to highlight. We’re starting to see brands, even on connected TV, you can’t really click, but the ability to showcase a product that you think will engage an audience. An overlay. Those types of things are ways for brands not to double or triple their creative investments, but work with a partner to customize an existing creative that they have for CTV or YouTube.

Caroline Cakebread:

Thanks so much. And moving on here as we’re approaching time. I’ll give this one to you again, Moe: What is the best attribution model to use when approaching CTV measurement?

Moe Chughtai:

That is a loaded question. There’s literally a lot there. I’ll just start with, I don’t think there’s a best model in general for a brand. I think it really, really depends on the industry you’re in, the type of products you’re advertising, and what the buy cycle for those products look like. If you’re a retailer who’s advertising fast fashion, the perks decision for a buyer is completely different than Jackie’s example of a four month journey to figure out: Which Jeep or which car do I want to buy? And which brand, which model, which year? Those are completely different buy cycles, right? So if you’re a brand, you really need to consider what your typical buy cycle looks like in that sort of attribution window.

I will say, there’s some things that are important in general. So having an attribution model that consider multiple formats and not just individual publisher or in an individual format is really important. So, working with partners … and this is where MiQ really tends to work with brands, who are running across, they display audio and CTV and YouTube all at once. Being able to look at a consumer journey across multiple ends of that buy decision, means you just get a fuller picture of how different formats are working together. And so, you’re not getting to a place where a search is taking 100% of the credit for every conversion, or display, or what have you. But you can find how each of these are at least contributing to each other.

And so, without going too much into last click or last view or first view, best practice for brands to start with is finding partners who can work across multiple formats.

Caroline Cakebread:

Awesome, thanks so much. Appreciate you taking that one on there.

All right. Jackie, I will pose this one to you. And we’re going back to talking about children’s programming again, that seems to be something that’s on a lot of people’s minds: So have you found a simple solution to excluding children’s YouTube programming from your buy without having to go in and exclude specific channels?

Jackie Paulino:

Yeah. I mean, this ties back to the last question that I answered around the brand suitability. We do. We have, at Pixability, curated tens of thousands of channel lists specific. And we, again, do a lot of data science analysis to understand the content, the context of that content, the sentiment surrounding that and really what is happening within the video. And so, using that technology, we’ve curated lists of made for kids content. And we use that kind of as a negative list if someone does not want to run on that.

It’s not something someone that works at an agency or brand would want to do manually. It would be … I suppose not impossible if you dedicated your life to it, but it would take many years. It’s taken us a lot of time to come up with the perfect solution. We actually just launched a new solution called BrandShield a few weeks ago, and we’ve been working on this problem since 2012. So, it is a complex issue, is the brand suitability part and really understanding YouTube videos. So we have curated lists, again, in the tens of thousands, hundreds of thousands, that are specific to children’s content and that’s how we solve that problem for our advertisers.

Caroline Cakebread:

Awesome. Thanks for touching on that again. I think it’s definitely an interesting thing.

And also this one to you again actually, Jackie: Do you optimize differently for different screens on YouTube like TV, mobile, desktop? And is there enough volume to plan and optimize separately?

Jackie Paulino:

Yeah. I’m glad this question popped up too. So I think, Moe and I have been talking about TV screens specifically. I mean, it depends, again, on the campaign and what the KPI of that campaign is, where it makes most sense for you to be running your ads. Most of our advertisers that we work with do run across TV, mobile and desktop. And then depending on the audience, depending on the creative, depending on the KPI, we optimize towards the best combination of those things. Our technology allows us to do that in an automated fashion where we have dozens of hundreds of combinations and optimize towards what works best.

Jackie Paulino:

But, holistically, I would say it’s smart for advertisers to start thinking about TV screens separately. For the most part, we still have budgets that are planned for YouTube, just as YouTube and not YouTube for TV screens and YouTube for mobile. But they are different, right? And I think thinking about YouTube on a TV screen, closer to other CTV strategies, makes sense. And like Moe just touched on, the creative might be different, right? Your mobile creative should be different than your TV creative. But you just might also have different audiences. You might want to reach light TV viewers, someone who’s cut the cable. And really use YouTube on TV screens as a way to reach that audience and then use mobile and desktop just for additional reach.

But, I guess, short answer: Yes, I would think of these things differently. And if you’re not going to think about them differently, definitely segment and optimize towards what works best.

Moe Chughtai:

I would say, with most buyers who are running on YouTube, they’re really, to your point, not considering the screen individually in that optimized plan that they’ve got. And so, if you’re a buyer who’s looking for efficiencies on YouTube, one of the real clear ways to do that is, if I’m able to get on a bigger screen with a potential for co-viewing in a little bit of a higher impact opportunity, buying the same sort of YouTube content on a TV screen feels like a real opportunity to improve the performance of that campaign.

And what we’re seeing is that tends to be an under-leveraged opportunity for most advertisers. So, it definitely should be one of the things that brands are considering, if they’re not doing it already.

Jackie Paulino:

Definitely.

Caroline Cakebread:

Awesome. Well, thank you both so much.

So we are going to leave it there. So I’d like to thank our speakers so much for taking the time to be with us today. And I guess this is your last reminder here, you will be getting a link to the on-demand version of this presentation later this afternoon. So feel free to watch it again if you feel so inclined, or share it with your colleagues and friends.

So, thank you so much everyone. We look forward to seeing you on an upcoming Adweek webinar.